Example of Cost Allocation. In this example, the cost driver selected is 'machinery hours.' It is determined that after every 1,000 machine hours, maintenance costing $500 is performed. Samsung .bu file viewer.zip. Therefore, every machine hour results in an eventual 50 cents in maintenance costs that can be allocated to the product being manufactured based on the cost driver of machine hours.

Page/Link: Page URL: HTML link: The Free Library. Retrieved Mar 10 2019 from The current accounting literature is filled with activity based costing ABC~ articles about cost drivers in manufacturing settings but very few examples of cost driver applications in service firms or industries exist. A number of the applications of cost drivers in manufacturing plants, however, involve service functions rather than a manufactured product. Since cost driver and ABC concepts improve the cost measurement and allocation information for service departments within manufacturing firms, service firms (such as accounting or law firms) could also use cost driver and ABC concepts. A change to cost driver techniques will provide better cost information for service firms as it has for manufacturing firms.

Activity based costing will help accounting firms answer questions such as: What does it cost to prepare a tax return? What is the cost of doing an audit? How should the common costs be allocated to a particular engagement? Can costs be measured better and used for pricing of services? Cost Allocations Cost allocations are arbitrary and cannot be proven correct (or incorrect) because they depend on subjective judgement and not on a verifiable cause/effect relationship. Even though arbitrary, allocations are done in practice because the advantages outweigh the disadvantages.

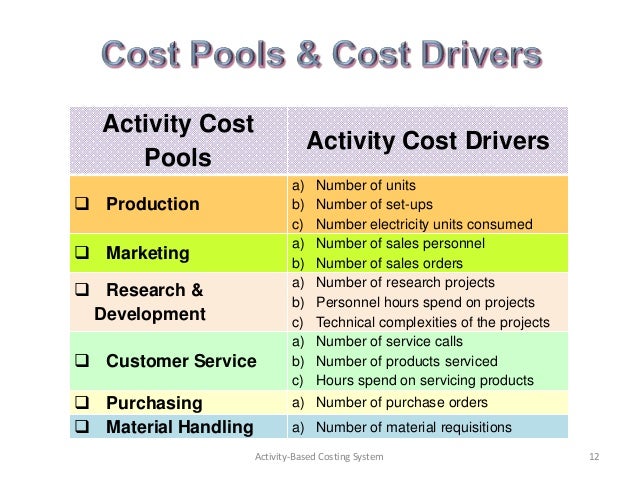

The methodology for making cost allocations involves two separate issues: 1. The pools or categories of indirect costs that should be identified, aggregated and allocated together. The basis over which the costs in any given pool should be allocated. It is the second issue that gives rise to the search for cost drivers or allocation bases. A number of criteria are used by companies for evaluating cost allocation methods.

Most authorities agree allocations should be made on the basis of the factors that caused the cost to be incurred. This criterion is most useful for variable costs like direct labor in an accounting or a law firm. It is less useful for fixed costs--like office rent or building depreciation--that represent a capacity decision by the firm to provide facilities for a particular level of service. Cost Drivers The most acceptable method of assigning costs to a product or service is to select drivers that approximate the underlying behavior of the costs to be allocated. This causal relationship is generally regarded as the best method for allocating indirect costs. It is the theory behind 'cost driver' methods. A cost driver is used to allocate costs based on a common measure of the quantity of the resource used by the product (or service, department, contract or unit).

The cost driver concept focuses on the activity that drives or causes the consumption of cost. This is in contrast to the concept of allocating costs just because they were incurred and must be assigned to the products or services to satisfy external users. Since fixed costs do not vary with changes in activity in the short run, there are no 'cost drivers' that reflect usage, and any allocation is arbitrary. If fixed costs are to be allocated, a firm will need to develop some common capacity measure for all cost centers. Variable costs vary with a change of activity and it is precisely this variation, and the activity that causes the variation, that gives rise to the search for cost drivers. For short-term variable costs, such as supplies or photocopy expenses, cost drivers use a measure of resource consumption directly proportional to the volume of activity, usually in units, products or hours of service.

Long-term variable costs such as professional development or continuing education expenses are often not related to the volume of the units, products or hours of service but are instead related to other causal factors. For long-term variable costs, the types of activities or transactions undertaken are often used as the cost drivers.

It is necessary to: (1) understand the forces that cause the cost to change; and (2)identify and select a cost driver that behaves in the same manner as those variable costs. Cost Drivers in Service Firms Service firms differ significantly from manufacturing firms in that they are labor intensive rather than capital intensive. Sinhala video songs free download. Most of the labor cost can be traced directly to the firm's output of services. The rest of the cost is usually charged to a single overhead cost pool and then allocated to specific engagements, usually as a percentage of direct labor cost. This charge for overhead will distort the total cost of the engagement if different types of jobs cause costs to be incurred that are not in proportion to the number of hours worked or the direct labor cost incurred. If the accounting system arbitrarily allocates costs to a job rather than allocating costs that reflect the true inputs, the firm will not be competitive when bidding jobs and will be measuring performance incorrectly.

New Articles

- Twilight Breaking Down Part 1 With Hindi Subtitle Movie Counter

- Hakko 927 Esd Manual

- Prezentaciya Kubicheskij Decimetr I Litr 4 Klass

- Cenniki Obrazec Na Yarmarku

- Praktikum Po Obschestvovedeniyu

- Navigon Navigator 7 Crack

- Broadcast Scheduling Software

- Gathers Vxd 055c Manual

- The Path Of Least Resistance Robert Fritz Pdf

- Say It Like You Mean It The Starting Line Rar Download Free Apps

- Pss E Software Crack

- Torrent Crack Anno 1701 Serial

- Shabloni Voennoj Formi Vvs Dlya Foto Na Dokumenti

- Jcd 201m Base Microphone Manual

- Bernard Cornwell The Lords Of The North Pdf Free